The nation's biggest banks aren't insolvent.

Decisive action by the Fed and Treasury has kept the nation's economy from careening into the abyss.

Ah... these giddy feelings are wonderful.

The only really distressing thought is that so many of "my fellow citizens" are so completely clueless that they'll believe this corn-littered raft of crap coming out of Washington and regurgitated by the various morons in the financial press and mainstream media.

Now you know my take on the "stress test." Time for the rest of the story, or "Why Bernanke, Paulson, and Geithner need to be thrown in prison.

Overview

- "More Adverse" scenario is already here

- Capital requirements "fudged" -- complete with nuts

- Government will backstop the need for funds

Prime Delinquency

One of the main assumptions that went into the test of these banks was that defaults on prime mortgage loans would not exceed 3-4%. That's important because so much of the potential losses to the banks (roughly $455 billion is attributable to residential mortgages and consumer related loans) are mortgage driven. That would be really bad. The really bad news is that this level of default on prime mortgages isn't some "way out there" unlikelihood. Just how probable is it?

Fannie Mae's Q1 2009 report shows that 3.15% of their prime mortgages are three or more months past due. If you haven't paid your mortgage for the past quarter of the year, what are the odds you're suddenly going to make a payment next month? You'd better have one helluva couch with magic cushions.

It's a safe bet that we've already hit this key level in the "more adverse" scenario. Naturally enough, not a thing was said about this in the news. You certainly didn't hear Geithner or Bernanke mention it, even though this information was available prior to the release of the stress test results.

As a quick aside, the amount of total mortgage related losses predicted in the "more adverse" scenario is also laughably optimistic. Where the test results were predicated on losses just south of $1,000 billion by the end of 2010, the IMF is expecting between $2,400 billion and $4,100 billion, Roubini is expecting losses to exceed $2,000 billion, and Karl Denninger of Market Ticker is expecting between $2,500 billion and $3,000 billion in residential mortgage losses. Once again, the "adverse scenario" is wildly optimistic.

Unemployment -- dreaming of jobs

Another key metric of the "more adverse" scenario was that unemployment could hit 8.9% by the end of 2009 and go all the way to 10.3% by the end of 2010. Unemployment is a key measure impacting banks because unemployed people:

- Tend to stop paying on their credit card

- Tend to stop paying on their car payment

- Sometimes even stop paying on their mortgage

- They don't purchase additional financial "products"

The "more adverse" scenario is actually the "dreaming of candy and unicorns" scenario.

Capital Requirements

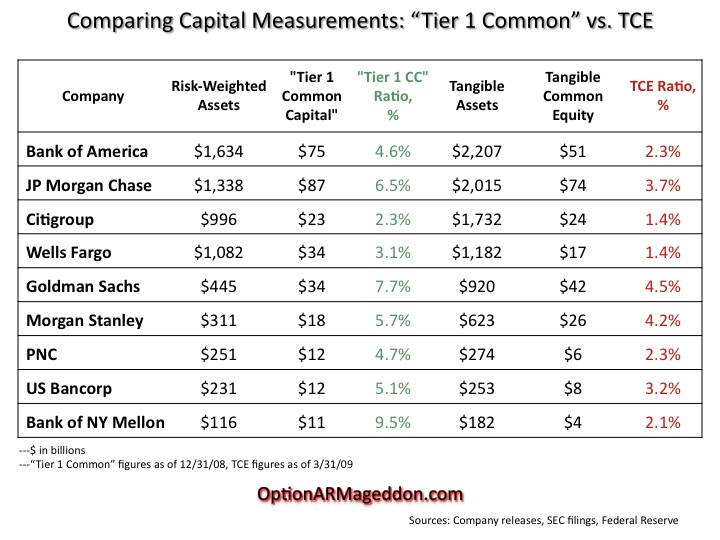

The other side of the stress test was an evaluation of the banks ability to withstand the losses under the various scenarios. You might expect that this is more straightforward -- a loss of $100 dollars burns through $100 dollars in capital. If we were talking about this a decade ago, you'd be right. We would be measuring the capital cushion of the banks in terms of their Tangible Common Equity (basically the value of the assets of the company minus liabilities, and most importantly, minus things that would be worthless if the company had to liquidate (like deferred taxes and goodwill). In a nutshell, TCE is what a bank actually can use to absorb losses in its loan portfolio.

The initial plan for the stress test was that it would consider the banks need to raise capital in light of their potential losses (from the unicorns and candy scenario) as gauged by the TCE of the various banks.

Well, that was dumb. This turned out to be a horrible way to measure the ability of the banks to withstand the losses they are facing. The numbers looked really bad this way. The "stress test" would hardly be effective at convincing investors that all was okay when the results clearly indicated that large chunks of sky had been crushing banks and would continue to do so for the forseeable future.

Instead, the banks were able to negotiate with the Fed to instead use consider their Tier 1 Common Captital. This worked out much better for the banks. Naturally. Some samplings of Tier 1 ratios vs. TCE ratios (note that TCE ratios don't hit 5% at any of these guys):

That whole "capital cushion" that banks are supposed to maintain to avoid getting shut down by their regulator... Well, yeah, not so much. Fortunately, banks intend to increase their revenues in order to help fill the huge enormous gastly gaping void.

That whole "capital cushion" that banks are supposed to maintain to avoid getting shut down by their regulator... Well, yeah, not so much. Fortunately, banks intend to increase their revenues in order to help fill the huge enormous gastly gaping void.Right.

All of this seems really odd until we get to the final point, after which everything starts making sense again.

You're the Backstop

If you have even half a pulse it is obvious that the banks are seriously short on capital. However, instead of the FDIC shutting the banks down, breaking up their assets and selling them in pieces off to solvent banks, Tim Geithner has committed to the government backstop them. If the banks can't raise the money they need in the market, then the government (or the Federal Reserve -- which isn't really part of the government) will provide them the capital they need. Heads they win, Tails you lose.

You can fast forward to about 9:30 into Charlie Rose's interview with Geithner for that gem.

Here's what I'm wondering. Why bother going through the sham of a "stress test" if the insolvent banks aren't going to be allowed to fail anyway? It seems pretty clear to me that the results were known more or less in advance and that the only purpose was to convince investors that "everything was going to be alright."

Frankly, I think we are about to get Fed'rolled (in the spirit of Rick-rolling).

It's now quite reasonable that the results of the test dribbled out in leaks over the course of a week or so. The "stress test" was purely a marketing tactic. At the end of the day, you are on the hook to either pay off the enormous loan the Treasury will need to backstop these insolvent banks, or suffer dramatic inflation at the hands of a rapacious and completely opaque Federal Reserve bank.

All the purported good news has helped drive financial stocks higher, which has in turn played a key role in helping some big names sell new shares to the public -- increasing their capital cushion. Increasing the capital cushion is good, necessary even. What I find to be seriously fraudulent is the government taking an active role in lying about the health of these companies in an effort to put lipstick on a zombie so that people will be duped into investing in them.

Before the schadenfreude sets in, it's worth considering some of the trends that have been analyzed of late over at Zero Hedge. Basically, the smart money has been heading out of the market. The large institutional buyers, yeah, they're not playing because the valuations are making no sense whatsoever. Instead, the growth in price is coming on decreasing volume.

There's talk of panic buying -- people calling their broker in a rush to buy to avoid missing out on the "bull market." While a fool and his money are soon parted, the government shouldn't be actively trying to punch him in the nose as a distraction for the pickpockets.

Thank goodness for the new-found transparency in Washington!

No comments:

Post a Comment